Economics 1 – Lecture 18: Government Spending: Fiscal Policy

[youtube http://www.youtube.com/watch?v=TXPJeRJFuzs&fs=1&rel=0]

Introduction to Economics.

Video Rating: 4 / 5

[youtube http://www.youtube.com/watch?v=TXPJeRJFuzs&fs=1&rel=0]

Introduction to Economics.

Video Rating: 4 / 5

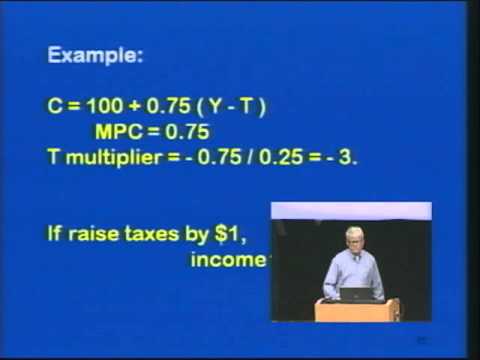

There is a very subtle, very important point made at 22:43.

When the government taxes $1, the effect on the CURRENT economy is a $1

* MPC/(1-MPC) decrease

When the government spends $1, the effect on the CURRENT economy is a $1 *

1/(1-MCP) increase

So $1 of government spending has a greater impact on the CURRENT economy

than a $1 tax because the governments MPC is 100%, they don’t save any of

their income.

HOWEVER, The tax effects more than just this years economy. A tax of $1

ALSO reduces SAVINGS by $1 – $1*MCP

That means that when you tax, you are also reducing FUTURE consumption and

investment.

This is a grotesque example of how Keynesian “math” justifies an expansion

of government activity. If we start from a basis analyzing the basic

actions of individuals and governments, we would come to a totally

different conclusion: that government intervention used to stimulate the

economy is more destructive than beneficial.