Four Points Regarding 2015 Housing Outlook

Chicago, IL (PRWEB) March 03, 2015

Lenders like Peoples Home Equity were intrigued by a recent February 26th article from Corelogic titled “February 2015 Economic Outlook.”

Corelogic, the financial, property information, and real estate analytics provider is a staple of housing information for lenders like Peoples Home Equity.

The key points that Corelogic underscored are:

Employers have added over 1 million people to their payrolls in the last 3 months; the largest increase in 18 years

Oil price drop has done more to increase consumer confidence than five years of economic growth

Soaring consumer confidence bodes well for new home sales and residential construction

Key oil market home price overvaluation much smaller than 1980s or 2000s and negative impact of oil price drop will be more muted

Peoples Home Equity has long held the opinion that America’s strengthening labor market is going to eventually translate to a generation of first-time home buyers. Corelogic highlighted how strong America’s labor market currently is by stating “Job growth ended on a high note in 2014, reaching a 2.1 percent increase from the prior year in December – the highest rate of employment growth since March 2006 which was the peak of the last economic cycle.” For America’s younger labor force the statistics are even stronger “The employment growth for 25 to 34 year olds was 2.4 percent, the highest growth rate in 27 years.”

Thanks to their new found jobs America’s youth are growing ever more interest in a purchasing a condo versus paying rent for their apartment. This is underlined by the fact that frequently, the combined costs of a mortgage + association fees + property taxes are less than the monthly cost of rent! Since the recession more individuals have become employed, this has given them time to build or rebuild their credit scores and finally save for a down payment on a home. For those fortunate enough to have secured a raise or a higher paying job, sub 4% mortgage rates may be offered to them. Yet, even for those offered 4.5% interest rates should be grateful given that compared to economic history, borrowing has never been so cheap for so long.

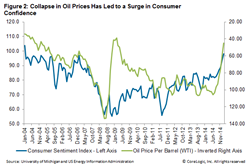

Regarding the price drop in oil, American’s can use their gas savings pay down their mortgage a bit more by fitting in an extra payment or two per year. Or, lien holders may save their gas savings to refinance their home loan for the current sub 4% interest rates offered now. Corelogic graphically shows in its article that there is a strong link between consumer confidence and oil prices, so strong in fact that “the drop in oil prices the last six months has done more to increase consumer confidence than five years of job and economic growth.” One should know that this “link between consumer confidence and oil prices has not just occurred the last six months but over the last two decades.” However, the “relationship broke down in late 2008 and 2009 because consumer outlook was so weak due to the Great Recession during which oil price movements became less relevant.” Now that the economy has improved that “the strong correlation reverted to its old pattern.”

People Home equity thinks builders would increase housing output once they see another surge in weekly mortgage applications, something the lender follows and writes about frequently. Corelogic stated “Q4 data for builders suggest momentum is already building. Between Q4 2013 and Q4 2014, new residential orders for 7 selected home builders increased 16 percent, up from a 4 percent decline a year ago and the trend continued into January for several builders.”

On a final note regarding key oil centric cities of America, Corelogic states “Assuming oil prices remain low, the negative impact on home prices will likely be much more muted in New Orleans and Oklahoma City than in the past since prices in the two markets are currently more in line with income driven fundamentals.”

If in need of a mortgage, contact a Peoples Home Equity loan officer today at: 262-563-4026

Find More Economics Press Releases