Ranking the States’ Fiscal Health: New Study

Arlington, Virginia (PRWEB)

July 08, 2015

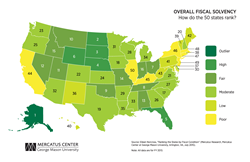

This week, the Mercatus Center at George Mason University released detailed rankings exposing the fiscal health of every U.S. state, in the most comprehensive academic study of its kind.

“These rankings are an early warning system for policymakers, journalists, and the public,” said the study’s author, Mercatus Senior Research Fellow Eileen Norcross. “While no ranking can capture all of a state’s fiscal dynamics, these can serve as a tool to guard against short-term and long-term risks or economic shocks.”

In many states, revenues are increasing and budget gaps are shrinking. But there are clouds on the horizon in the form of growing health care and pension cost commitments and credit rating downgrades.

States that carry low levels of debt and spending rank highly, as do those with the built-in advantage of abundant oil and gas revenues. States with structural financial problems and unsustainable pension systems place at the bottom.

Overall State Fiscal Health Rankings:

1. Alaska

2. North Dakota

3. South Dakota

4. Nebraska

5. Florida

6. Wyoming

7. Ohio

8. Tennessee

9. Oklahoma

10. Montana

11. Utah

12. Nevada

13. Alabama

14. Missouri

15. Idaho

16. Indiana

17. South Carolina

18. Iowa

19. Texas

20. New Hampshire

21. Virginia

22. Colorado

23. Washington

24. Kansas

25. Oregon

26. Georgia

27. North Carolina

28. Wisconsin

29. Arkansas

30. Delaware

31. Minnesota

32. Arizona

33. Mississippi

34. Michigan

35. Louisiana

36. New Mexico

37. Maryland

38. Rhode Island

39. Vermont

40. Hawaii

41. Pennsylvania

42. Maine

43. West Virginia

44. California

45. Kentucky

46. New York

47. Connecticut

48. Massachusetts

49. New Jersey

50. Illinois

The rankings include five separate sub-rankings assembled from 2013 state financial reports (the most up-to-date set available):

Cash Solvency: Which states can pay their short-term bills?

Budget Solvency: Which states have enough money on hand for a full fiscal year?

Long-Run Solvency: Which states have enough revenue coming in to cover yearly costs, including pension benefits and infrastructure?

Fiscal Slack: Which states have enough fiscal slack to increase spending?

Trust-Fund Solvency: Which states have the most debt or unfunded pension and health care liabilities?

For individual state web pages, more maps, video, or the complete study, please visit mercatus.org/statefiscalrankings.